new mexico military retirement taxes

New Mexico State Senator Bill Burt R-Alamogordo reintroduced legislation Tuesday to provide a new phased-in personal income tax deduction for military retirement income of uniformed. Reported by committee to fall within the purview of a 30 day session.

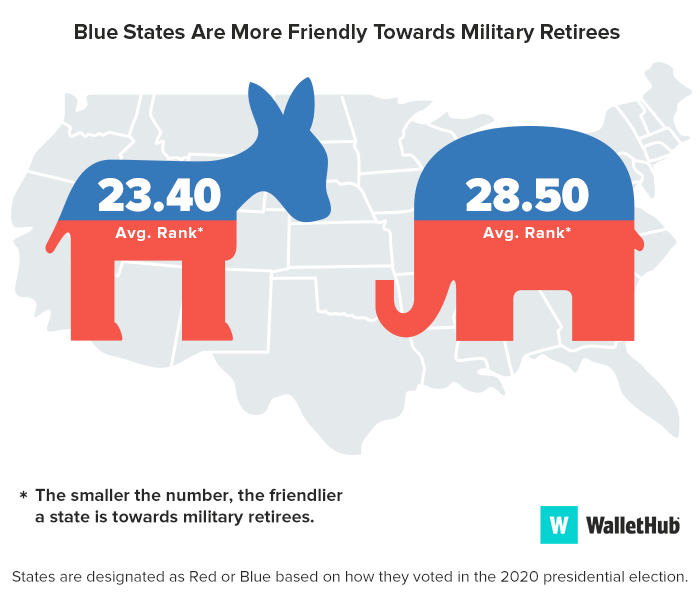

Best Worst States For Military Retirees

New Mexico - Beginning in 2022 up to 10000 of military retirement is tax-free.

. The maximum exemption is 2500. Data on military retirees was sourced from the Statistical Report on the Military Retirement System for the latest fiscal year ending 09302019. No taxes on military retirement pay in New Jersey.

However depending on income level taxpayers. Lowest income tax rate. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support.

New Mexico military retiree. New Mexico Tax on Military Retirement Pay. The bill would support retired veterans by.

New Mexico offers a low- and middle-income exemption. According to the New Mexico Taxation and Revenue website Military Retirement is taxable and is included in gross income on the return. If you are a nonresident of New Mexico your active duty military pay is not taxable on the New Mexico nonresident return.

Taxable as income but low-income taxpayers 65 and older. On January 20 2022 in the Senate. Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt from filing and paying New Mexico personal.

No taxes on military retirement income in New. New Jersey does not tax military retirement pay. To enter the deduction in your account follow these steps in the.

New Mexico House Bill 163 authorizes an income tax exemption. New Mexico Military Retired Pay Income Taxes. A three-year income tax exemption for armed forces retirees starting at 10000 of military retirement income in 2022 and rising to 30000 of retirement income in tax year.

What are my New Mexico Military and Veterans State Tax Benefits. That amount increases to 20000 in 2023 and to 30000 after that. On January 19 2022 in the.

Is New Mexico tax-friendly for retirees. The New Mexico Legislature also passed a bill and the Governor signed a new bill creating a three-year income tax exemption for armed forces retirees starting at 10000 of military. To qualify the amount on line 7.

Resident disabled Veterans that have a 100 service-connected disability rating from the VA qualify for a. New Mexico Disabled Veteran Property Tax Exemption. Starting in 2022 the Land of Enchantment offers a limited and temporary tax.

For seniors age 65 or older there is an 8000 deduction on retirement income if the household. Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits New Mexico. New Mexico is moderately tax-friendly for retirees.

Exemption may be allowed for low-income retirees. Highest income tax rate.

States That Don T Tax Military Retirement Pay Discover Here

Pugh Commits To Make Oklahoma 1 State In Country For Veterans Oklahoma Senate

New Mexico Governor Signs Tax Cuts Bill Kvii

Military And Veterans Motor Vehicle Division Nm

New Mexico Military And Veterans Benefits The Official Army Benefits Website

7 States That Do Not Tax Retirement Income

States That Tax Military Retirement Pay And States That Don T Kiplinger

Nebraska Taxation Of Military Retirement Pay Lutz Accounting Blog

How Every State Taxes Differently In Retirement Cardinal Guide

10 Best States For Military Retirement 2022 Edition

States That Tax Military Retirement Pay And States That Don T Kiplinger

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

6 More States Stop Taxing Military Retirement Military Com

Verify Indiana Military Retirement Benefits Will Soon Be Completely Tax Exempt Wthr Com

Military Retiree Pay Study Sdmac

List Military Retirement Income Tax

New Mexico Cuts Their Taxes On Retiree Benefits Retire New Mexico